What is the Drukyul Life Insurance Plan?

Drukyul Life Insurance Plan (DLIP) is a one-year term life insurance renewable every year. It works in the same manner as Rural Life Insurance.

For example, if you bought it on the 27th of October 2023, it should be renewed before the 12:00 am of 26th of October 2024.

Who is eligible?

Every Bhutanese family and their members aged five (5) years and above are eligible for the Drukyul Life Insurance Plan.

How does it work?

Any Bhutanese can subscribe to the Drukyul Life Insurance Plan whether you’re sick, elderly, or unemployed. No medical documents, reports, or certificates are required, unlike other life insurance policies. But the condition here is that every family member, meaning everyone under the household member list aged five (5) years and above must be insured. For example, if there are seven (7) members aged five (5) years and above in the household list, you must insure all the seven (7) members.

How much does a member pay?

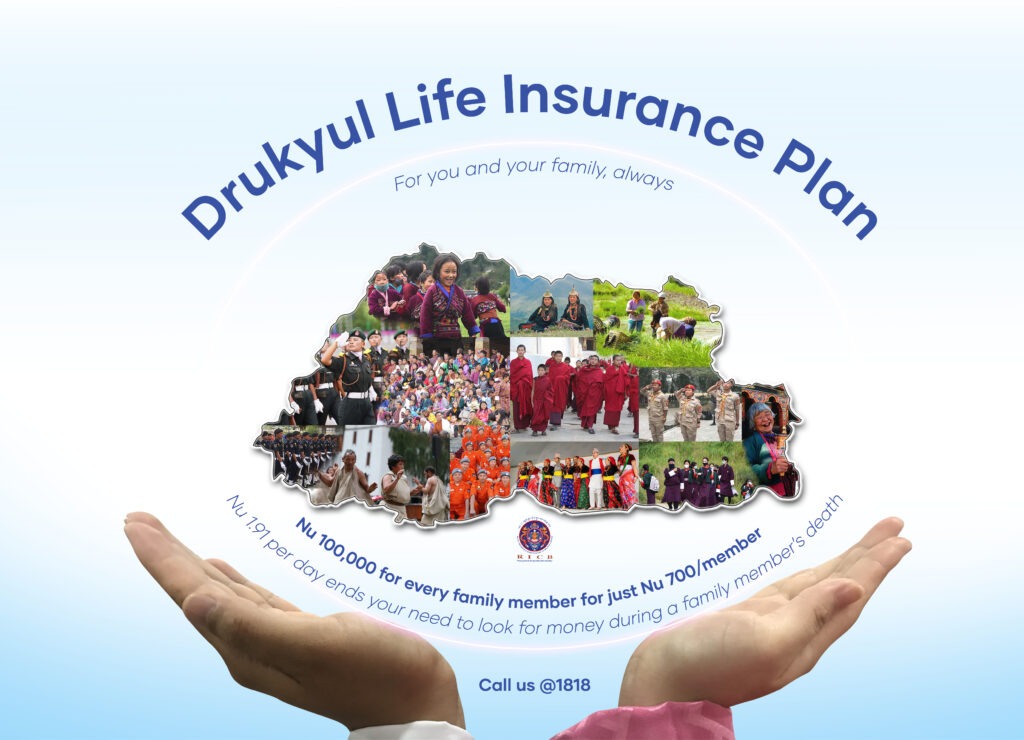

Nu 700 per member per year. If the household has seven (7) members, they have to pay Nu 4,900 every year and likewise.

What is the amount of claim for the Drukyul Life Insurance Plan?

Nu 100,000 upon the death of the member.

What are the modes of payment for the Drukyul Life Insurance Plan?

You can pay yearly before the policy lapses. For example, if you applied on the 27th of October 2023, then it must be renewed before 12:00 am, 26th of October 2023.

How to apply?

The fastest, cheapest, and easiest way is to subscribe from our MyRICB App. You can directly obtain from the MyRICB App without any hassle. But remember to keep a screenshot of the Payment Receipt you will receive by the end of the application. You can also visit of our Branch Offices in your area for help or call us @1818.

Aum Yeshi from Chelekha in Toebesa, Punakha receives Nu 130,000 (Nu 100,000 for Drukyul Life Insurance & 30,000 for Rural Life Insurance) as compensation for the loss of her nephew.

Do you have an option to insure the members selectively?

Unfortunately, no.

Why is there no option to choose the members?

That’s because Drukyul life insurance is a social welfare scheme like Rural Life Insurance. While we collect a premium of only Nu 700 per member per year, we dish out Nu 100,000 as a claim if a member dies during the policy period.

In other words, we pay each member 143 times more than we collect. So, for us to recover the Nu 100,000 claim for every member, we must insure 143 more people.

Also, providing an option to select the members leaves the policy vulnerable to exploitation and misuse since some people might only insure the sick and vulnerable members of their family. If such practice is allowed, it poses an existential threat to the policy, which could upend the very sustainability of the Drukyul Life Insurance Plan within months.

Is it mandatory to take the Drukyul Life Insurance Plan?

Not really. Drukyul Life Insurance Plan is an option for people to protect their families from financial security and provide social safety net. If you think the benefits from the Rural Life Insurance of Nu 30,000 aren’t enough, you can also take DLIP.

1.Providing timely relief to relatives of the deceased

2.To help citizens meet expenses on funeral rites

Instill a sense of protection during difficult times

Is there a deadline to apply for the Drukyul Life Insurance Plan?

Not really. You can apply for the plan when you’re ready and have enough money to insure all the household members. But as is always in insurance, it’s always advisable to insure yourself and your family members’ as early as possible.

Is Rural Life Insurance and Drukyul Life Insurance the same product?

No. Rural Life Insurance is a compulsory life insurance plan for every Bhutanese aged 8 years and above initiated by the Royal Government of Bhutan as social welfare scheme.

But Drukyul Life Insurance Plan is a new life insurance plan providing an option to people. We however advise everyone to avail the Drukyul Life Insurance Plan for better risk coverage and financial resilience for the family.

What is the difference between Drukyul Life Insurance and Rural Life Insurance?

Rural Life Insurance

Eligibility: Bhutanese, 8 years and above

Premium per member per year: Nu 87

Government Subsidy: Nu 108 per member per year

Benefits: Nu 30,000 upon death of the member

Condition: Mandatory for all the Bhutanese aged 8 years and above

Household members: All the members.

Drukyul Life Insurance Plan

Eligibility: Bhutanese, 5 years and above

Premium per member per year: Nu 700

Benefits: Nu 100,000 upon death of the member

Condition: Mandatory to insure all the members of the household.

Do you still have to pay for Rural Life Insurance?

Yes, you must. It’s still mandatory for all the Bhutanese aged 8 years and above.

Has the premium been raised for the Rural Life Insurance from the previous premium per member per year?

No. The premium for Rural Life Insurance remains the same. It’s still Nu 87 per family member annually.

Can I change the member list in the household?

Yes, you can, provided there is the change in the census registration. Just contact our customer care @1818 during the office hours for help.

Who is entitled to make the claim?

Only the head of the household is eligible to claim the benefits. Where there is no head of the household — the family member next in line shall be provided the claim.

What documents are required to process the claim?

CID and Death Certificate from the hospital if the person has died in a hospital. If the person has died outside of the hospital apply for Death Registration from the one’s gewog.

Why was Drukyul Life Insurance Plan started?

Bhutan — as we all know — is a religious country where the dead are not only revered highly but have a tradition and culture of preparing generous funeral rites so that the dead can transcend the intermediate state and attain swift rebirth to higher realms. But with the cost of essential commodities rising every year, arranging funeral rites is increasingly becoming a financial burden for the bereaved families.

Because many families struggle to meet these funeral finances, Dzongkhag Tshogdus and Gewog Tshogdes have also repeatedly approached us to raise the existing Rural Life Insurance of Nu 30,000 that we whenever someone dies in the family. Many local leaders, private citizens, and villagers have also suggested to increase the claim for the RLI.

Following this, the RICB began working with the government to increase the RLI Claims from Nu 30,000. This idea, however, couldn’t come through because of the government’s current financial constraints.

Therefore, we introduced a new life insurance, Drukyul Life Insurance Plan, while retaining the Rural Life Insurance at the same time as a different product like before.

Our objective here is to solely protect the families from financial burden during the death of a family member.

Tax rebate?

It’s being discussed with the relevant regulatory body. An update shall be provided as soon as we have something concrete on it.

Is there any discount?

Not possible under this scheme.

Would a member still be entitled to claim if he/she hasn’t renewed the policy in the year of death but has paid for the years before his/her death?

We cannot provide the claim under such circumstances because Drukyul Life Insure is a one-year term life insurance, which ought to be renewed every year before the policy lapses.

Is there a chance of double payment while paying from the MyRICB App?

No. Normally once the payment confirmation is made, the system doesn’t accept more than one payment.